bank owned life insurance tier 1 capital

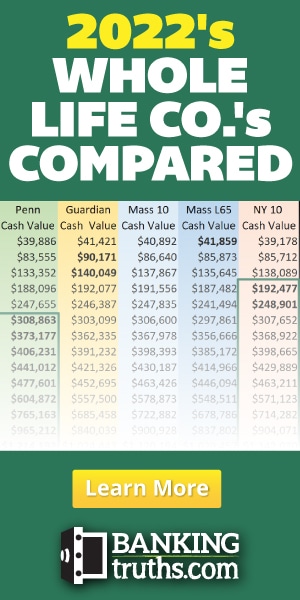

It is generally not prudent for an institution to hold BOLI with an aggregate CSV that exceeds 25 percent of its Tier 1 capital. FDIC is Tier 1 Capital only When considering a BOLI transaction the regulators require a Bank to insure that the transaction complies with its legal lending limit and concentration of credit limit.

Bank Owned Life Insurance Or Boli For Better Investment Returns

Tier 1 capital represents a banks equity and reserves.

. Bank owned life insurance tier 1 capital Thursday March 3 2022 Edit. Bank-owned life insurance BOLI is a form of life insurance used in the banking industry. No Medical Exam - Simple Application.

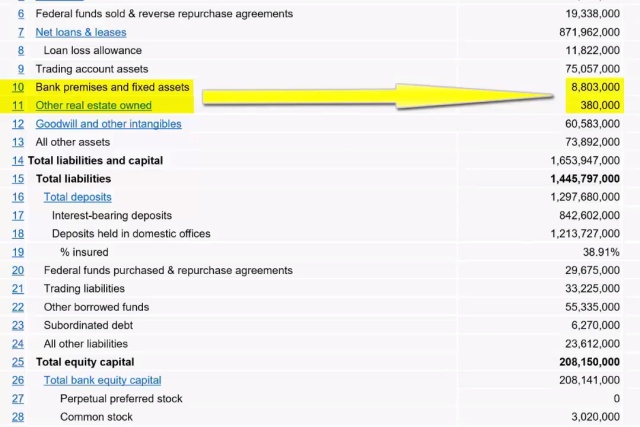

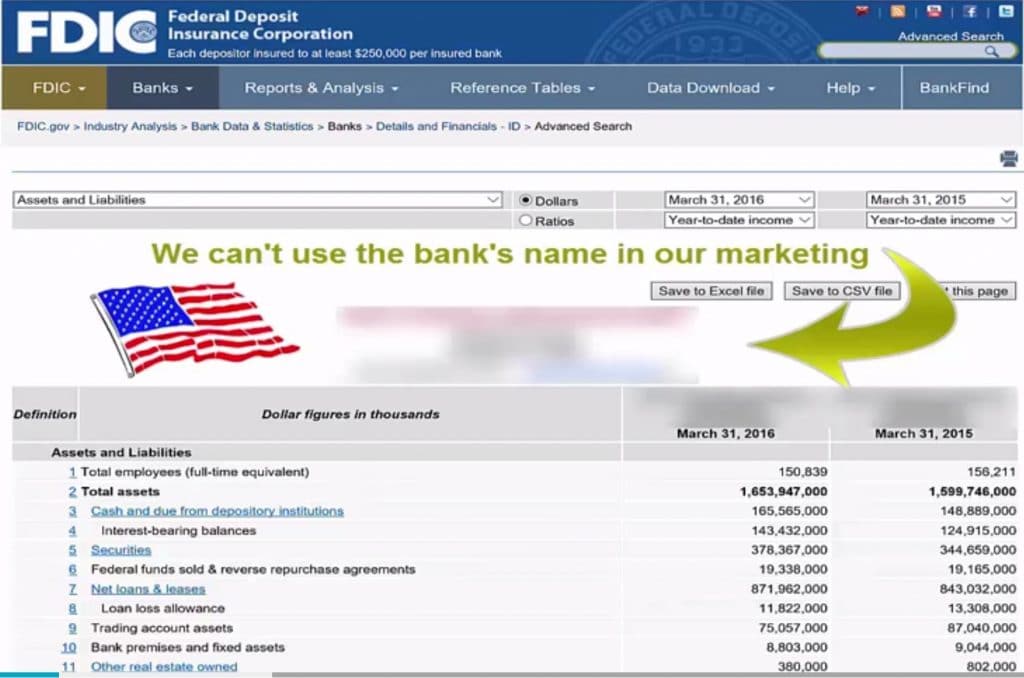

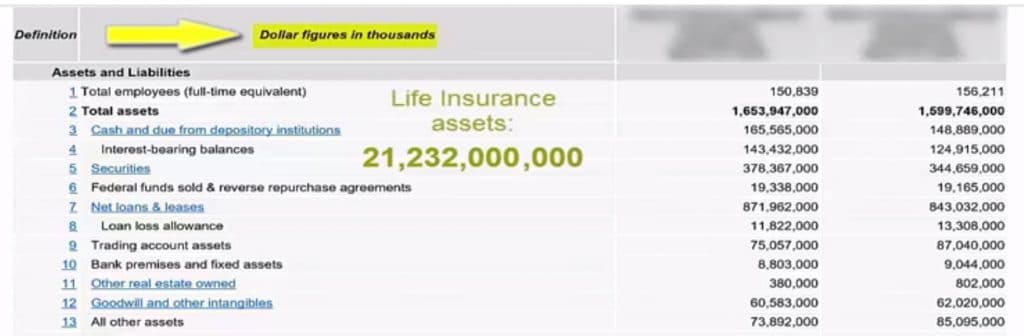

Bank Owned Life Insurance BOLI uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions. A Little Known Way Banks Make Money. Corporate owned life insurance assets COLI and Bank owned life insurance BOLI assets may account for close to 1 trillion or more of.

Bank normally uses less than 25 of Tier 1 capital to fund the bank owned life insurance policies. A BBB Rated Companies. 2021s Top 5 Life Insurance.

Therefore the FDIC expects an institution that plans to acquire BOLI in an amount that results in an aggregate CSV in excess of this concentration limit or any lower internal limit to gain prior approval from its board of directors or the. Bank owned life insurance is reviewed and evaluated to determine reasonableness and the overall impact on the banks safety and soundness during regulatory examinations. Yes No If Yes why didnt the bank purchase.

The bank sells 1 million worth of its taxable portfolio and uses the proceeds to pay for a single premium BOLI. Since 1979 David Capital Partners Inc. Can have as much as 25 of Tier 1 capital tied to insurance.

Banks may hold up to 25 of regulatory capital Tier 1 in BOLI. In accordance with OCC 2004-56 and SR 04-19 the bank should not exceed 25 of their Tier 1 Capital plus ALL. Initial lump-sum premium investment equals cash surrender value on day one.

The BOLI transaction involves a reallocation of Tier I capital assets. Ad 5 Best Rated Life Insurance Plans 2021. Tier 1 capital refers to a banks equity capital and disclosed reserves.

Apply 100 Online In 5 Min. 25 of tier 1. Case Study Key Man Insurance Utilizing Company Owned Life Insurance To Protect The Business Provide Executive Compensation In One Solution Insurance Agents Guide To.

It is advisable to use top 30 bank executives to avoid any potential income tax consequences. Bank owns life insurance 3. Using BOLI we increase current earnings and shareholder value to fund employee benefit liabilities including group medical plans deferred compensation and.

Banks use it as a tax shelter and to. Has provided Bank-Owned Life Insurance BOLI to Oklahoma banks. More may be obtained.

25 of Tier 1 capital for BOLI 15 with any one carrier for General Account BOLI less an allowance for loan loss reserves. Ad Valuable Term Coverage from 10000 to 100000. As Low As 349 Mo.

But since the recession higher capital requirements and other factors have made bank-owned life insurance or BOLI increasingly attractive. 2 Bank-Owned Life Insurance BOLI the premium owns the cash value of the policies and is the beneficiary of the insurance. Products are no-load no-surrender charge and all of the income is tax-free if policies are held to maturity.

Easy Online Application with No Medical Exam Required Just Health and Other Information. The Federal bulletin OCC 2004-56. If the bank does not currently own life insurance has that option been considered or looked into.

Assume that a bank has an average Tier I capital earnings rate of 5. As a whole 55 of all banks have more than 35 of their Tier 1 assets in BOLI. Bank owned life insurance policy is held as Tier 1 assets on key employees to act as supportive capital for the funding of other deferred compensation plans.

Tier 1 capital has. What percentage of the banks Tier 1 capital is currently tied to insurance. Ad No Medical Exam-Simple Application.

Senior management board oversight and administration. When properly designed. The insurance offers tax breaks and counts as Tier 1 capital while producing higher yields than most Tier 1 investments.

The bank is the owner and beneficiary of the policies. See Our 1 Pick. See Your Rate and Apply Online.

Tier 1 capital. Banks continue to keep the life insurance policies on retired or separated executives as the rate of return on this kind of arrangement is much higher when it is held for a long time. Excessive compensation There are no specific statutory limits other than safety and soundness considerations.

If the bank has a 40 marginal tax rate this translates to a rate of 3 on a net after-tax basis. Many banks own 15 to 25. Who has to vote to implement a BOLI.

As Low As 349 Mo. It is used to measure the banks capital adequacy.

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Decoding Boli And Coli Paradigmlife Net Blog

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Private Family Banking System With Whole Life Insurance Paradigm Life

Boli Explained Paradigm Life Blog Post

Boli Bank Owned Life Insurance The What And The Why

Understanding Sipc And Fdic Coverage Ameriprise Financial

Decoding Boli And Coli Paradigmlife Net Blog

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Bank Owned Life Insurance Or Boli For Better Investment Returns

Bank Owned Life Insurance Or Boli For Better Investment Returns

Insurance Agents Guide To Bank Owned Life Insurance Redbird Agents

Bank Owned Life Insurance Boli

Boli Bank Owned Life Insurance The What And The Why

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths